I prefer crimp unless on at an area that it can't be used. It should be mentioned that there is a correct way to apply a crimp to crimp connectors. All crimp connectors start out as a flat piece of metal that is shaped into a cylinder, so they have a seam where the edges meet that runs the length of the connector. The connector should be placed in the crimping tool with the seam at 12 o'clock (facing up). When the jaws are closed, the shaped crimper die presses down on the seam from above, bends and crushes the connector metal, compresses and traps the wire strands and produces a tight crimp. A connector that's crimped with the seam in a different position may still work, but the connector may not assume the desired crimped shape and its grip on the wire strands may not be as tight as a result.

Second, I've learned that the European Union (EU) has passed legislation requiring the removal of all lead from solder. This has presented problems in electronic items. With the lead removed, tiny whiskers can form on a solder joint that can short out adjoining connections.

Reference : www.motor.com

Search Auto-Repair-Questions

Showing posts with label Articles. Show all posts

Showing posts with label Articles. Show all posts

Monday, December 13, 2010

Thursday, December 02, 2010

Preparing Your Vehicle For a Long Trip this Winter

Personally, I prefer to get to my destination; instead of siting on the side of the road waiting for the tow truck. Preparing your car for the trip is simple. This article is intended to briefly educate on how simple checks will keep you moving forward. Read on.

Automobiles are my specialty. I repair and service an average of one to five a day, with a comeback rate of 2%. Only 2 out of 100 vehicles return to me because of my mistake or a part failure. I take pride in educating auto owners about the importance of a reliable automobile. In order to prepare yourself for a successful commute on a long trip use a basic check list.

- Check the oil, you should check the oil on your car or truck once a week, but absolutely check it before a long drive.

- Check the tires, automotive tires will loose air over time. This can result in a major problem on the road, like a blow-out. Tires will malfunction if not inflated properly.

- Check the coolant, overheating can be damaging to the vehicles engine resulting in roadside assistance.

- Inspect the belts & hoses, a belt braking can cause a number of things; including battery charging and power steering malfunction.

In summary, I have briefly explained some basic checks on your car that should be performed, before a long trip. Make sure to consult a qualified auto service mechanic for further assistance. The auto mechanic should be able to assist you with other procedures that are necessary to make your automobile road worthy. Keep your ride off of the hook and have a save trip.

Automobiles are my specialty. I repair and service an average of one to five a day, with a comeback rate of 2%. Only 2 out of 100 vehicles return to me because of my mistake or a part failure. I take pride in educating auto owners about the importance of a reliable automobile. In order to prepare yourself for a successful commute on a long trip use a basic check list.

- Check the oil, you should check the oil on your car or truck once a week, but absolutely check it before a long drive.

- Check the tires, automotive tires will loose air over time. This can result in a major problem on the road, like a blow-out. Tires will malfunction if not inflated properly.

- Check the coolant, overheating can be damaging to the vehicles engine resulting in roadside assistance.

- Inspect the belts & hoses, a belt braking can cause a number of things; including battery charging and power steering malfunction.

In summary, I have briefly explained some basic checks on your car that should be performed, before a long trip. Make sure to consult a qualified auto service mechanic for further assistance. The auto mechanic should be able to assist you with other procedures that are necessary to make your automobile road worthy. Keep your ride off of the hook and have a save trip.

Sunday, November 28, 2010

On-board Internet is just around the corner, experts say

BERLIN -- On-board Internet will soon become a regular option in cars as the necessary technology makes its mass market breakthrough in the next few years. That is the view of experts meeting at the Automobilwoche Congress in Berlin.

“On-board Internet can be here very quickly. It can happen in two to three years. It goes hand-in hand with the continued, rapid development of car-to car communication" Ulrich Kurth, an automotive specialist at T-Systems told the Congress.

Automobilwoche is a sister publication of Automotive News Europe.

All the components necessary to roll out the technology are at hand. "The chemical mixture has become explosive. We have everything. Now it's only a matter of how these components come together." he added.

But Stefan Bratzel, manager of the Center of Automotive at the University of Applied Sciences in Bergisch Gladbach added a cautionary note, warning automakers that they shouldn't underestimate the attractions of on-board Internet and allow non-automotive companies to provide universal standards for the technology before they do.

“We are going to have the Google generation in high-volume cars. The industry must internalize this from the outset,” Bratzel said.

Attracting young drivers

Bratzel added that the Internet could play a key role in making cars more attractive to young people, who already use Internet regularly.

“To become more attractive to young people, the auto industry must offer something that they now use naturally on a daily basis.”

He added that carmakers could also use the technology to maintain and shape future customer relationships.

“On-board Internet can assure the OEMs' contact with the customer beyond the sales process,” he said.

But not every aspect of the existing technology for on-board Internet points to the future, according to T-Systems's Kurth. He doesn't consider the current leading applications such as Ford Sync and Onstar to be the way forward.

“These solutions continue to be quite simple," Kurth said. "They don't lend themselves to expansion.”

“On-board Internet can be here very quickly. It can happen in two to three years. It goes hand-in hand with the continued, rapid development of car-to car communication" Ulrich Kurth, an automotive specialist at T-Systems told the Congress.

Automobilwoche is a sister publication of Automotive News Europe.

All the components necessary to roll out the technology are at hand. "The chemical mixture has become explosive. We have everything. Now it's only a matter of how these components come together." he added.

But Stefan Bratzel, manager of the Center of Automotive at the University of Applied Sciences in Bergisch Gladbach added a cautionary note, warning automakers that they shouldn't underestimate the attractions of on-board Internet and allow non-automotive companies to provide universal standards for the technology before they do.

“We are going to have the Google generation in high-volume cars. The industry must internalize this from the outset,” Bratzel said.

Attracting young drivers

Bratzel added that the Internet could play a key role in making cars more attractive to young people, who already use Internet regularly.

“To become more attractive to young people, the auto industry must offer something that they now use naturally on a daily basis.”

He added that carmakers could also use the technology to maintain and shape future customer relationships.

“On-board Internet can assure the OEMs' contact with the customer beyond the sales process,” he said.

But not every aspect of the existing technology for on-board Internet points to the future, according to T-Systems's Kurth. He doesn't consider the current leading applications such as Ford Sync and Onstar to be the way forward.

“These solutions continue to be quite simple," Kurth said. "They don't lend themselves to expansion.”

Monday, November 22, 2010

Should I buy a Chevy or a Ford?

Ohio dealer Chris Haydocy heard it even at dinner parties: "Government Motors."

In conservative Buckeye country, it meant a fat "no, thank you" to vehicles from General Motors Co., whose majority stakeholder was the federal government.

Texas Chevrolet dealer Carroll Smith said he won't be happy until the government has sold its stake in GM. The IPO reduced U.S. ownership from 61 percent to about 33 percent.

Smith, who will sell about 1,600 new vehicles this year at Monument Chevrolet in Pasadena, Texas, is convinced that the stigma of government ownership cost him sales.

He said he has heard at the country club, especially from his Republican friends, how Ford Motor Co. deserved praise for not taking federal bailout money. "It's not quantifiable, but I'm sure it's happened," Smith said of lost sales.

He said he bought the maximum 800 shares of GM common stock offered at the IPO price to GM dealers, employees and retirees.

Tom Durant, a Dallas-area Chevrolet dealer and member of both the GM and Chevrolet dealer councils, said product will determine GM's future. With improving sales and a bankruptcy-scrubbed balance sheet, GM will have more money going forward to invest in product development, he said.

"We had new product coming out during bankruptcy and lots afterward," said Durant, owner of Classic Chevrolet. "That's what this game is all about."

This year, GM has launched the Chevrolet Cruze compact, the Chevy Volt plug-in sedan, heavy-duty full-sized pickups and the Buick Regal mid-sized sedan.

Ohio dealer Haydocy -- whose Haydocy Buick-GMC will sell about 500 new vehicles this year, about the same number as 2009 -- said nothing succeeds like success.

He said the good vibe from the IPO is likely to make some consumers curious again about GM vehicles, which should boost showroom traffic. Haydocy also owns a small Chevrolet, Buick and Cadillac store in Bucyrus, Ohio.

Said Haydocy: "People aren't investing because of civic pride; they want to see the story behind the success."

In conservative Buckeye country, it meant a fat "no, thank you" to vehicles from General Motors Co., whose majority stakeholder was the federal government.

Texas Chevrolet dealer Carroll Smith said he won't be happy until the government has sold its stake in GM. The IPO reduced U.S. ownership from 61 percent to about 33 percent.

Smith, who will sell about 1,600 new vehicles this year at Monument Chevrolet in Pasadena, Texas, is convinced that the stigma of government ownership cost him sales.

He said he has heard at the country club, especially from his Republican friends, how Ford Motor Co. deserved praise for not taking federal bailout money. "It's not quantifiable, but I'm sure it's happened," Smith said of lost sales.

He said he bought the maximum 800 shares of GM common stock offered at the IPO price to GM dealers, employees and retirees.

Tom Durant, a Dallas-area Chevrolet dealer and member of both the GM and Chevrolet dealer councils, said product will determine GM's future. With improving sales and a bankruptcy-scrubbed balance sheet, GM will have more money going forward to invest in product development, he said.

"We had new product coming out during bankruptcy and lots afterward," said Durant, owner of Classic Chevrolet. "That's what this game is all about."

This year, GM has launched the Chevrolet Cruze compact, the Chevy Volt plug-in sedan, heavy-duty full-sized pickups and the Buick Regal mid-sized sedan.

Ohio dealer Haydocy -- whose Haydocy Buick-GMC will sell about 500 new vehicles this year, about the same number as 2009 -- said nothing succeeds like success.

He said the good vibe from the IPO is likely to make some consumers curious again about GM vehicles, which should boost showroom traffic. Haydocy also owns a small Chevrolet, Buick and Cadillac store in Bucyrus, Ohio.

Said Haydocy: "People aren't investing because of civic pride; they want to see the story behind the success."

Monday, October 25, 2010

New Honda CRZ, is it worth it?

The New Honda CRZ is a completely new designed econo-sport 2 seater. Looks awesome, drives awesome, lots of new technology and well.... I think a bit over priced for what your getting($19,200). You can buy a new Honda Civic for less money($15,800) and it gets only a few miles per gallon less than the CRZ(26 CITY 34 HWY). Don't forget the civic can carry 4 passengers as well. Oh, I hear ya, what about the whole Go Green issue? Well, I can think of keeping more of the Green in my pocket for starters. You may burn slightly less fuel per gallon(a difference of a few gallons on hwy only.35 CITY 39 HWY) but now you have to burn coal as well to charge the battery. Hmmmm doesn't sound very Green at all to me. But if your just going for the latest and greatest Wow factor. The New Honda CRZ is a great option for all. For myself, I'm a bit disappointed in Honda for building a hybrid car thats no more advanced in the fuel mileage area than it is. In part its my own fault for having such high expectations for an extrordinary car company.

Thursday, October 14, 2010

Google is testing a car that drives itself - No Driver needed for Google Car

NEW YORK (Reuters) - Google Inc, the world's largest Internet search engine, has been tinkering with engines of another sort and come up with some futuristic results -- a car that drives itself. Video of Google Car

Google, in a posting on its official blog, said it has developed the technology and been busy testing a fully automated car that would take the controls out of the hands of distracted drivers, leaving them free to text, eat or apply makeup to their heart's content.

"Our goal is to help prevent traffic accidents, free up people's time and reduce carbon emissions by fundamentally changing car use," Google said on its blog.

The automated cars use video cameras, radar sensors and a laser range finder to "see" other traffic, as well as detailed maps to navigate the road ahead.

The futuristic autos have already been tested on the heavily trafficked California roadways -- including highways, bridges and busy city streets. They have even navigated San Franciso's famed Lombard Street, a tourist favorite known as the nation's most dramatically winding address.

All in all, our self-driving cars have logged over 140,000 miles, Google said.

All of the test runs have had a driver behind the wheel just in case. The driver can take over as easily as one disengages cruise control, Google said, adding that test drives have also included a trained software operator in the passenger seat to monitor the software.

Google said it believes its self-driving cars might one day cut by half the more than 1 million traffic fatalities suffered each year.

For those ready to shell out hard-earned cash for one of the first self driving autos, Google said the project "is very much in the experimental stage" providing only "a glimpse" of what transportation might look like in the future.

It remains to be seen whether Google investors, who have been concerned by the company's spending, will applaud its automotive aspirations. The company missed Wall Street's earnings estimates in the second quarter and is due to report third quarter results later this week.

Source: ca.reuters.com

Google, in a posting on its official blog, said it has developed the technology and been busy testing a fully automated car that would take the controls out of the hands of distracted drivers, leaving them free to text, eat or apply makeup to their heart's content.

"Our goal is to help prevent traffic accidents, free up people's time and reduce carbon emissions by fundamentally changing car use," Google said on its blog.

The automated cars use video cameras, radar sensors and a laser range finder to "see" other traffic, as well as detailed maps to navigate the road ahead.

The futuristic autos have already been tested on the heavily trafficked California roadways -- including highways, bridges and busy city streets. They have even navigated San Franciso's famed Lombard Street, a tourist favorite known as the nation's most dramatically winding address.

All in all, our self-driving cars have logged over 140,000 miles, Google said.

All of the test runs have had a driver behind the wheel just in case. The driver can take over as easily as one disengages cruise control, Google said, adding that test drives have also included a trained software operator in the passenger seat to monitor the software.

Google said it believes its self-driving cars might one day cut by half the more than 1 million traffic fatalities suffered each year.

For those ready to shell out hard-earned cash for one of the first self driving autos, Google said the project "is very much in the experimental stage" providing only "a glimpse" of what transportation might look like in the future.

It remains to be seen whether Google investors, who have been concerned by the company's spending, will applaud its automotive aspirations. The company missed Wall Street's earnings estimates in the second quarter and is due to report third quarter results later this week.

Source: ca.reuters.com

Monday, September 27, 2010

Home of the Free Alignment just a myth?

If you live in the US and ever listen to the radio you can't help but hear one of the great commercial going on and on about a free alignment with the purchase of new tires. So we want to clear the air about this free alignment business.

1) they do provide an alignment if you purchase 4 New Tires (PAY the operative word) the price is built in dummy!!

2) Did you wreck your car or have front end work done recently that requires an alignment? Probably not, so you do not need an alignment. Now you are paying more for your tire than you need to so you can get an alignment you don't need. Smart on the advertisers part. Most people do not know that they do not need an alignment.

3) Well my car is pulling? Again, if you didn"t wreck it... you just need tires replaced and no need for over priced tires to get an alignment.

How much do they charge for an alignment without purchasing tires? $69.95. So divide that by 4 and that's about $17.50 per tire. Could you buy tires for $17.50 a tire less. YES, so I am going to have to say that you are not getting a FREE Alignment. Don't let shifty advertising convince you otherwise. Stay alert when dealing with Big Brand Tire Stores.

1) they do provide an alignment if you purchase 4 New Tires (PAY the operative word) the price is built in dummy!!

2) Did you wreck your car or have front end work done recently that requires an alignment? Probably not, so you do not need an alignment. Now you are paying more for your tire than you need to so you can get an alignment you don't need. Smart on the advertisers part. Most people do not know that they do not need an alignment.

3) Well my car is pulling? Again, if you didn"t wreck it... you just need tires replaced and no need for over priced tires to get an alignment.

How much do they charge for an alignment without purchasing tires? $69.95. So divide that by 4 and that's about $17.50 per tire. Could you buy tires for $17.50 a tire less. YES, so I am going to have to say that you are not getting a FREE Alignment. Don't let shifty advertising convince you otherwise. Stay alert when dealing with Big Brand Tire Stores.

Thursday, September 23, 2010

Opel will build rival to Ford's Ka in Germany

Saturday, September 18, 2010

New Chinese policy may force foreign automakers to share intellectual property

Wednesday, September 08, 2010

GM's OnStar said to consider free services, targeting Ford

DETROIT (Bloomberg) -- General Motors Co.'s OnStar in-car communications unit may offer some free services next year to rival Ford Motor Co.'s Sync music and information system, two people familiar with the plans said.

OnStar, a subscription service that provides accident alerts, directions and vehicle diagnostics, is scheduled to introduce an upgraded system this month that links vehicles to the social media site Facebook and translates voice messages to text, said the people, who asked not to be identified because the details aren't public.

In-car technology features attract tech-savvy consumers and allow carmakers to charge more for smaller, cheaper models, said Brandy Schaffels, an analyst at TrueCar.com. GM, the largest U.S. automaker, is adding features to keep pace with systems including Ford's Sync.

“When Ford came out with Sync, they met OnStar's services and upped the ante,” Schaffels, content manager at the California-based researcher, said in an interview. “Technological features are where GM and Ford are going to found their reputation with the next generation.”

OnStar may begin offering entertainment and information services that link to a user's smartphone without a subscription or fee, said one of the people. OnStar is now offered free in many models for the first year and then for $199 to $299 a year, depending on the features.

Jocelyn Allen, a spokeswoman for OnStar, declined to comment.

Voice-to-text

The voice-to-text system will be studied with a test audience while the company decides whether to offer it to all customers, the person said. The new version of OnStar will have enhanced services for emergency response, which alerts an OnStar operator when there is a vehicle crash, the person said.

OnStar will unveil a new advertising theme with the tagline “Live On,” while individual services will have their own themes, such as “Always On” to promote accident alerts, the people said.

The unit also is studying ways to use OnStar outside of the car, where immediate contact with an operator or access to other services such as safety or security might be useful, said the people, who declined to give specifics.

OnStar, available on more than 40 vehicles from GM's 2011 model year, has about 5.7 million subscribers, according to a GM regulatory filing. OnStar and Google Inc. said in June they would partner to offer eNav, a turn-by-turn navigation feature that allows drivers to send Google Maps destinations to their vehicle.

Ford Sync

Ford has been selling Sync, based on Microsoft Corp.'s in- car, voice-activated technology, since the 2008 model year, Alan Hall, a Ford spokesman, said in a telephone interview. The company added features such as touch-command controls and voice-activated climate control this year.

The technology, available as a $395 option on some models, helps make cars more profitable and is included standard on higher-end vehicles.

Ford said in January it plans to bring social networking, Web browsing and thumb controls similar to those on Apple Inc.'s iPod into 80 percent of its models by 2015.

OnStar, a subscription service that provides accident alerts, directions and vehicle diagnostics, is scheduled to introduce an upgraded system this month that links vehicles to the social media site Facebook and translates voice messages to text, said the people, who asked not to be identified because the details aren't public.

In-car technology features attract tech-savvy consumers and allow carmakers to charge more for smaller, cheaper models, said Brandy Schaffels, an analyst at TrueCar.com. GM, the largest U.S. automaker, is adding features to keep pace with systems including Ford's Sync.

“When Ford came out with Sync, they met OnStar's services and upped the ante,” Schaffels, content manager at the California-based researcher, said in an interview. “Technological features are where GM and Ford are going to found their reputation with the next generation.”

OnStar may begin offering entertainment and information services that link to a user's smartphone without a subscription or fee, said one of the people. OnStar is now offered free in many models for the first year and then for $199 to $299 a year, depending on the features.

Jocelyn Allen, a spokeswoman for OnStar, declined to comment.

Voice-to-text

The voice-to-text system will be studied with a test audience while the company decides whether to offer it to all customers, the person said. The new version of OnStar will have enhanced services for emergency response, which alerts an OnStar operator when there is a vehicle crash, the person said.

OnStar will unveil a new advertising theme with the tagline “Live On,” while individual services will have their own themes, such as “Always On” to promote accident alerts, the people said.

The unit also is studying ways to use OnStar outside of the car, where immediate contact with an operator or access to other services such as safety or security might be useful, said the people, who declined to give specifics.

OnStar, available on more than 40 vehicles from GM's 2011 model year, has about 5.7 million subscribers, according to a GM regulatory filing. OnStar and Google Inc. said in June they would partner to offer eNav, a turn-by-turn navigation feature that allows drivers to send Google Maps destinations to their vehicle.

Ford Sync

Ford has been selling Sync, based on Microsoft Corp.'s in- car, voice-activated technology, since the 2008 model year, Alan Hall, a Ford spokesman, said in a telephone interview. The company added features such as touch-command controls and voice-activated climate control this year.

The technology, available as a $395 option on some models, helps make cars more profitable and is included standard on higher-end vehicles.

Ford said in January it plans to bring social networking, Web browsing and thumb controls similar to those on Apple Inc.'s iPod into 80 percent of its models by 2015.

Thursday, September 02, 2010

Redesigned 2011 Dodge Durango has three rows of seats, new logo

New Dodge Durango

The Durango will be built at Chrysler's Jefferson North assembly plant on the same platform as the Jeep Grand Cherokee. It will arrive in dealer showrooms in the fourth quarter this year.

The Durango comes with seven seats while the Grand Cherokee comes with five. The Durango will have 22 seating configurations, according to a statement by the company. Like the Grand Cherokee, the Durango will be available with two engine options: a standard 3.6-liter Pentastar V-6 and an optional 5.7-liter HEMI V-8.

The new Durango will receive an all-new cabin as part of Chrysler's ongoing campaign to upgrade interiors across its entire lineup.

Chrysler stopped making the previous-generation Durango in 2008, when it shut down its Newark, Del., assembly plant. The new vehicle bears no resemblance to its predecessor. The old vehicle was a body-on-frame SUV derived from pickups. The new platform is a unibody-style structure with rear- or all-wheel-drive options.

Dodge is describing it as a “three-row performance vehicle.”

The Durango will be the first vehicle to sport the new Dodge logo, featuring a restyled, chrome-accented version of the crosshair grille that Dodge and Ram shared before Chrysler's new management separated the brands last year. The distinctive Ram's horns are gone, having stayed with Ram, which is now exclusively a truck brand.

The vehicle will make its first public appearance at the Dodge Rock ‘n' Roll Virginia Beach Half Marathon presented by SunTrust in Virginia Beach, Va., over the Labor Day weekend.

Although Dodge no longer sells trucks, it's still the top-selling brand in the Chrysler Group stable. Dodge sold 35,364 vehicles in August, up 8 percent over the same month last year.

Tuesday, August 31, 2010

U.S. proposes new labels for fuel economy, emissions

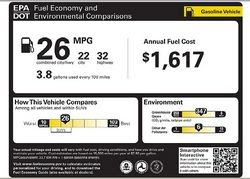

The Obama administration is carrying out a 2007 law that requires labels to put new vehicles in fleetwide context for fuel economy, greenhouse gases and smog-forming pollutants.

The comparison must cover electric vehicles, plug-in hybrids and conventional gasoline and diesel vehicles.

One part of the administration proposal would give each vehicle a bold letter grade from A+ to D for its fuel economy and greenhouse gases in comparison with the rest of the U.S. fleet.

The auto industry opposes this approach while many environmental groups support it.

Current labels have just a mile-per-gallon figure for the vehicle without any pollution ratings. Comparisons also are limited to the class of vehicle rather than the entire U.S. fleet. An SUV, for example, is compared just to other SUVs.

“We want to help buyers find vehicles that meet their needs, keep the air clean and save them money at the pump,” EPA Administrator Lisa Jackson said in a statement.

The EPA and U.S. Department of Transportation said they want to have the new labels in place for as many 2012 model cars and trucks as possible.

The proposed changes constitute the most significant overhaul of the fuel-economy label since its inception more than 30 years ago as automakers plan to introduce more fuel-efficient vehicles, the agencies said.

Advanced-technology vehicles

The administration today also proposed different labels for advanced technology vehicles -- including plug-in hybrids and electric vehicles -- that are soon to be mass-marketed.

These labels would contain additional information tailored to the technologies of the vehicles, the EPA said. For example, the label would identify how many miles the advanced technology vehicle can go before recharging or refueling.

The administration is seeking public comment over the next 60 days before it adopts a final rule.

The administration proposed two labeling approaches for vehicles.

One approach would feature a letter grade. The label also would estimate the vehicle's fuel-cost savings over five years compared with the fleet average.

The second proposal would keep the current label's focus on fuel economy and annual fuel-cost projections. Sliding-bar graphs underneath would compare the vehicle's fuel economy and tailpipe emissions with the fleet average.

The auto-industry lobby opposes letter grades, while a number of environmental groups favor it.

“Automakers support providing our customers with meaningful information for decision-making on vehicles that meet their particular needs, but the proposed letter grade falls short because it is imbued with school-yard memories of passing and failing,” said Dave McCurdy, CEO of the Auto Alliance.

The lobby represents Toyota, General Motors, Ford and eight other domestic and foreign manufacturers.

EVs would get an A+

Under the grading system, 17 of the 2,011 models in the current fleet would receive an A or above, said Gina McCarthy, an EPA assistant administrator.

Electric vehicles would get an A+, plug-in hybrids would get an A, and the “very best” hybrids -- such as Ford Fusions, the Honda Civic and the Toyota Prius -- would get an A-, she said.

A total of 14 vehicles in the current fleet would receive a D or D+. These include high-performance vehicles such as a Ferrari 612, McCarthy said.

The median grade would be a B-, she said.

Luke Tonachel, a vehicle analyst for the Natural Resources Defense Council in New York, said: “A bold letter grade would simplify the process of finding the cleanest, most efficient vehicles.”

McCarthy said it is possible the final rule will contain a blend of the two proposed approaches.

Misleading information?

Environmental groups expressed dismay that the proposed labels would not factor in pollution caused by electric vehicles' use of power plants for recharging.

This pollution is particularly acute in Midwestern and Eastern states, where generating facilities rely heavily on coal, environmental advocates said.

“It misleads consumers about how polluting the vehicle is,” said Daniel Becker, director of the safe-climate campaign at the Center for Auto Safety.

EPA said it intends to make this information available on the Web.

Tuesday, August 24, 2010

Prices of used SUVs, crossovers surge 30% from last year, Edmunds says

Some used SUVs and crossover vehicles are selling at retail for 30 percent more than they did last year, in a sign of how high used-vehicle prices remain. But on average, prices of used vehicles retreated again in July from record levels this spring.

Edmunds.com reports that the retail price paid for a used Cadillac Escalade, averaged over all model years, was $34,715 last month, up 36 percent from the average price paid a year earlier. The retail price paid for a used Dodge Grand Caravan in July, averaged over all model years, was $15,629, up 34 percent.

Joe Spina, Edmunds.com senior analyst, says a lack of confidence in the economy is driving more people to buy used vehicles. That puts upward pressure on prices of an already limited supply of used vehicles.

“This time last year, consumers were buying fuel-efficient vehicles and trading so-called gas guzzlers,” Spina says. “Now, those who need trucks and large SUVs are buying them, but the inventory is low because there is a current shortage of lease returns and trade-ins of this vehicle type.

“Prices are indeed very high now. While this is the case, last year’s prices were low, making the gains even more dramatic,” he says.

Even so, data from Manheim and ADESA Inc. show that wholesale used-vehicle prices in July declined from record high price levels this spring.

The average wholesale used-vehicle price in July was $10,060, ADESA says. That was 2 percent lower than the average price in June and less than 1 percent higher than the average price in July 2009.

The monthly Manheim Used Vehicle Value Index stood at 118.9 in July, down from 120.2 in the previous month but up from 115.4 in July 2009. The index is adjusted for make, model mix and time of year.

Edmunds.com reports that the retail price paid for a used Cadillac Escalade, averaged over all model years, was $34,715 last month, up 36 percent from the average price paid a year earlier. The retail price paid for a used Dodge Grand Caravan in July, averaged over all model years, was $15,629, up 34 percent.

Joe Spina, Edmunds.com senior analyst, says a lack of confidence in the economy is driving more people to buy used vehicles. That puts upward pressure on prices of an already limited supply of used vehicles.

“This time last year, consumers were buying fuel-efficient vehicles and trading so-called gas guzzlers,” Spina says. “Now, those who need trucks and large SUVs are buying them, but the inventory is low because there is a current shortage of lease returns and trade-ins of this vehicle type.

“Prices are indeed very high now. While this is the case, last year’s prices were low, making the gains even more dramatic,” he says.

Even so, data from Manheim and ADESA Inc. show that wholesale used-vehicle prices in July declined from record high price levels this spring.

The average wholesale used-vehicle price in July was $10,060, ADESA says. That was 2 percent lower than the average price in June and less than 1 percent higher than the average price in July 2009.

The monthly Manheim Used Vehicle Value Index stood at 118.9 in July, down from 120.2 in the previous month but up from 115.4 in July 2009. The index is adjusted for make, model mix and time of year.

Thursday, July 22, 2010

2011 Honda CR-Z

2011 Honda CRZ

It’s true that hybrids are fantastic when it comes to fuel economy. But is it too much to ask for driving enjoyment to go along with bragging rights at the fuel pump? Luckily for us, Honda provided the 2011 CR-Z hybrid with sharp handling to match its miserly fuel consumption. This futuristic-looking 2-passenger coupe is a genuine delight on a twisty road – so long as you don’t put a premium (pun intended) on horsepower. A 113-bhp 1.5-liter 4-cylinder is coupled to a 13-hp electric motor, whose battery pack is located beneath the cargo floor. The CR-Z is high-tech, but not rapid. Expect a 0-60 mph time of approximately 9 seconds—the same ballpark as many economy cars. Yet the ride and nimble handling make up for the lack of straight-line punch.

On sale in late August, and priced under $20,000 for the base model, the Honda CR-Z hybrid won’t be gathering dust on dealer lots.

Monday, July 19, 2010

Chinese enter U.S. by acquiring U.S. suppliers

After years of breakneck growth at home, China's parts makers are starting to reinvent themselves as global suppliers.

No longer content with shipping parts to North America, Chinese suppliers are acquiring U.S. companies and factories, often at bargain prices. In many cases they want to service North American customers -- particularly General Motors Co. and Ford Motor Co., which already do business with them in China.

In early July, for example, Tempo International Group, a Beijing supplier of brake, chassis and powertrain components, and its financial backer, the municipality of Beijing, formed a joint venture called Pacific Century Motors to purchase GM's Nexteer steering components unit for a reported $450 million.

"We want to become a mainstream supplier," Tempo Chairman Tianbao Zhou said in an interview last week at GM headquarters. "We want to blend in to the American culture."

Tempo is following in the steps of Wanxiang Group Corp.

In 1969, Lu Guanqiu, a former apprentice blacksmith, launched a farm tool repair shop with his wife, five partners and $500. Later he started producing universal joints for automakers.

Now his Wanxiang Group Corp. generates global sales of $8 billion a year. Wanxiang is in Hangzhou in China's Zhejiang province, on the eastern coast just south of Shanghai.

In 1994, Lu launched Wanxiang America Corp. in Elgin, Ill. In the late 1990s, the U.S. operation bought five distressed chassis component suppliers, keeping their American management in place.

Lu has continued buying. In 2007, the company purchased a driveshaft operation in Monroe, Mich., from Ford Motor Co.

The company's U.S. sales totaled $1.3 billion last year. At a recent industry event in Detroit, Wanxiang America President Pin Ni said he would consider other acquisitions of distressed suppliers.

Other Chinese suppliers will follow, says C. Peter Theut, the founder of China Bridge, an Ann Arbor, Mich., consulting firm that helps complete mergers of Chinese and U.S. companies. Over the past year, "We've been approached by 12 Chinese companies that want to come West," Theut says. Six were auto suppliers, he says.

Chinese cash

The Chinese generally seek small U.S. companies with niche products and annual sales of $20 million to $150 million. "The Chinese companies will come in with cash and supply the Americans with resources that they couldn't get from U.S. lenders," Theut says.

Although it's unclear how many Chinese automotive suppliers do business in the United States, the Detroit Regional Chamber counts at least 41 in the Detroit area alone. Companies range from small suppliers to the parts units of FAW Group and Shanghai Automotive Industry Corp., two of China's largest automakers.

"A number of Chinese suppliers want to get into the North American market," says Wayne County (Mich.) Executive Robert Ficano, who has led six trade missions to China. "And the automakers say, 'If you want to do it in the United States, you need to locate close to us.' "

Typically, these companies start small with a U.S. sales office and perhaps a technical center. After a few years they might start shopping for U.S. factories, says Ficano.

That was Tempo's approach -- financed by a Chinese government body. The Beijing municipal government has set up a $15 billion fund to help local companies, including Tempo, make acquisitions.

"With the support of Beijing, we are trying to take the company to the global stage," said Tempo's Zhou. With 2009 sales of $2.1 billion, Nexteer, of Saginaw, Mich., provides Tempo a platform "to build a much larger company."

Beijing's deep pockets offer Nexteer growth possibilities that it hasn't had in years. In 2006, bankrupt Delphi Corp. put its Saginaw Steering Gear unit up for sale. After Delphi was unable to find a buyer it sold the operation back to GM in March 2009. GM renamed it and put Nexteer up for sale in January.

As Delphi and then GM struggled through bankruptcy, Nexteer was forced to conserve cash. "I had to turn down growth opportunities because we didn't have the capital," said Nexteer President Robert Remenar.

Tempo's negotiations to buy Nexteer went well in part because the Chinese company had a track record on acquisitions. In March 2009, BeijingWest Industries Co. -- a partnership of China's Shougang Corp., the municipality of Beijing and Tempo -- bought Delphi Corp.'s brake operations for $100 million.

The Chinese influx will continue over the next couple of years, Theut predicts. "It's the U.S. suppliers that are so desperate, and the Chinese companies recognize that."

No longer content with shipping parts to North America, Chinese suppliers are acquiring U.S. companies and factories, often at bargain prices. In many cases they want to service North American customers -- particularly General Motors Co. and Ford Motor Co., which already do business with them in China.

In early July, for example, Tempo International Group, a Beijing supplier of brake, chassis and powertrain components, and its financial backer, the municipality of Beijing, formed a joint venture called Pacific Century Motors to purchase GM's Nexteer steering components unit for a reported $450 million.

"We want to become a mainstream supplier," Tempo Chairman Tianbao Zhou said in an interview last week at GM headquarters. "We want to blend in to the American culture."

Tempo is following in the steps of Wanxiang Group Corp.

In 1969, Lu Guanqiu, a former apprentice blacksmith, launched a farm tool repair shop with his wife, five partners and $500. Later he started producing universal joints for automakers.

Now his Wanxiang Group Corp. generates global sales of $8 billion a year. Wanxiang is in Hangzhou in China's Zhejiang province, on the eastern coast just south of Shanghai.

In 1994, Lu launched Wanxiang America Corp. in Elgin, Ill. In the late 1990s, the U.S. operation bought five distressed chassis component suppliers, keeping their American management in place.

Lu has continued buying. In 2007, the company purchased a driveshaft operation in Monroe, Mich., from Ford Motor Co.

The company's U.S. sales totaled $1.3 billion last year. At a recent industry event in Detroit, Wanxiang America President Pin Ni said he would consider other acquisitions of distressed suppliers.

Other Chinese suppliers will follow, says C. Peter Theut, the founder of China Bridge, an Ann Arbor, Mich., consulting firm that helps complete mergers of Chinese and U.S. companies. Over the past year, "We've been approached by 12 Chinese companies that want to come West," Theut says. Six were auto suppliers, he says.

Chinese cash

The Chinese generally seek small U.S. companies with niche products and annual sales of $20 million to $150 million. "The Chinese companies will come in with cash and supply the Americans with resources that they couldn't get from U.S. lenders," Theut says.

Although it's unclear how many Chinese automotive suppliers do business in the United States, the Detroit Regional Chamber counts at least 41 in the Detroit area alone. Companies range from small suppliers to the parts units of FAW Group and Shanghai Automotive Industry Corp., two of China's largest automakers.

"A number of Chinese suppliers want to get into the North American market," says Wayne County (Mich.) Executive Robert Ficano, who has led six trade missions to China. "And the automakers say, 'If you want to do it in the United States, you need to locate close to us.' "

Typically, these companies start small with a U.S. sales office and perhaps a technical center. After a few years they might start shopping for U.S. factories, says Ficano.

That was Tempo's approach -- financed by a Chinese government body. The Beijing municipal government has set up a $15 billion fund to help local companies, including Tempo, make acquisitions.

"With the support of Beijing, we are trying to take the company to the global stage," said Tempo's Zhou. With 2009 sales of $2.1 billion, Nexteer, of Saginaw, Mich., provides Tempo a platform "to build a much larger company."

Beijing's deep pockets offer Nexteer growth possibilities that it hasn't had in years. In 2006, bankrupt Delphi Corp. put its Saginaw Steering Gear unit up for sale. After Delphi was unable to find a buyer it sold the operation back to GM in March 2009. GM renamed it and put Nexteer up for sale in January.

As Delphi and then GM struggled through bankruptcy, Nexteer was forced to conserve cash. "I had to turn down growth opportunities because we didn't have the capital," said Nexteer President Robert Remenar.

Tempo's negotiations to buy Nexteer went well in part because the Chinese company had a track record on acquisitions. In March 2009, BeijingWest Industries Co. -- a partnership of China's Shougang Corp., the municipality of Beijing and Tempo -- bought Delphi Corp.'s brake operations for $100 million.

The Chinese influx will continue over the next couple of years, Theut predicts. "It's the U.S. suppliers that are so desperate, and the Chinese companies recognize that."

Saturday, July 10, 2010

Retro style and street-rod flair made PT Cruiser a star

The recipe was simple.

Use an existing small-car platform, mix in some nifty retro styling inside and out, build it in a low-cost country, and command a higher price.

When it made its debut at the 1999 North American International Auto Show in Detroit, the Chrysler PT Cruiser with its street-rod flair was an immediate sensation.

Americans either hated or loved the little wagon born during the SUV craze. Those that adored it had to have one of their own to cherish.

And it didn't hurt that it went on sale during the U.S. auto industry's biggest sales boom.

The last PT Cruiser rolled off an assembly line in Mexico today, marking the end of one of Detroit's most celebrated product runs in recent years. A Chrysler spokesperson said the last model was stone white and destined for a U.S. dealership.

It wasn't the first retro-styled car to tap into America's penchant for nostalgia. It followed Volkswagen's New Beetle but rolled before the Ford Thunderbird, BMW Mini and Chevrolet SSR.

But the little five-door hatchback certainly has been a soldier, with more than 1.35 million sold worldwide -- generating early waiting lists and fan clubs, spawning imitators in the Mini brand and Chevrolet HHR, and the subject of more special editions than any other vehicle in recent memory.

It was a refreshing new model in an era populated with a lot of redundant designs.

Bob Casey, curator of transportation at The Henry Ford museum in Dearborn, Mich., said the PT Cruiser, unlike the minivan, mixed practical function with attitude.

"Every time I see one I smile," he said. "I can well understand why they sold more than 1 million."

Unlike the Thunderbird and Mini, the PT Cruiser also made retro styling affordable to the masses, regardless of income, without trading away utility.

"It was an ideal single car or second family car," said Erich Merkle, an automotive analyst and president of Autoconomy.com. "For Chrysler, it was a gamble that paid off for 5 to 7 years."

Cash cow

It is the most profitable small car in Chrysler history, according to Bryan Nesbitt, who designed the original PT Cruiser for the old Chrysler Corp. Nesbitt is now a top General Motors Co. designer, while his former employer has since been steered by Daimler AG, Cerberus and Fiat S.p.A.

With the end of the PT Cruiser, Chrysler is retooling the Toluca, Mexico, plant to build the Fiat 500 -- a tiny car to be sold in the U.S. market beginning next year.

The PT Cruiser was originally tapped to join the aluminum Prowler roadster to bolster the ailing Plymouth brand. But when Chrysler planners scrapped Plymouth, the PT Cruiser was spared and christened a Chrysler, eventually becoming one of the brand's top-selling models.

Its offbeat style immediately attracted a variety of buyers -- the young, tuners, entrepreneurs and retirees. Many owners quickly fell in love with its functionality and quirky interior. The wagon's rear seats were removable, allowing the tall interior to stow large cargo.

To keep consumers interested, Chrysler added a convertible version, a woody model and a turbo engine. Special editions -- dubbed Flames, Chrome, Couture and Dream Cruiser -- were routinely added.

But over the years it mostly stayed the same and the novelty slowly wore off.

As with many retro-styled cars, an automaker can paint itself into a corner. Where do you go next?

"Chrysler stopped caring about it and the interior suffered from a lack of upgrades," said Joe Kyriakoza, vice president of marketing for Jumpstart Automotive Group.

But in a testament to its lasting appeal, even in recent years, the PT Cruiser was one of the most researched vehicles in Chrysler's lineup on many online shopping sites.

Annual global sales peaked at 192,000 in 2001, and in the absence of a major redesign, demand dropped to just 25,200 last year. In a nod to the original, the last models are referred to by Chrysler simply as PT Cruiser Classics.

"In the end, it was a hard act to follow because it was a fairly unique," said Casey. "They got it right, right out of the box."

Use an existing small-car platform, mix in some nifty retro styling inside and out, build it in a low-cost country, and command a higher price.

When it made its debut at the 1999 North American International Auto Show in Detroit, the Chrysler PT Cruiser with its street-rod flair was an immediate sensation.

Americans either hated or loved the little wagon born during the SUV craze. Those that adored it had to have one of their own to cherish.

And it didn't hurt that it went on sale during the U.S. auto industry's biggest sales boom.

The last PT Cruiser rolled off an assembly line in Mexico today, marking the end of one of Detroit's most celebrated product runs in recent years. A Chrysler spokesperson said the last model was stone white and destined for a U.S. dealership.

It wasn't the first retro-styled car to tap into America's penchant for nostalgia. It followed Volkswagen's New Beetle but rolled before the Ford Thunderbird, BMW Mini and Chevrolet SSR.

But the little five-door hatchback certainly has been a soldier, with more than 1.35 million sold worldwide -- generating early waiting lists and fan clubs, spawning imitators in the Mini brand and Chevrolet HHR, and the subject of more special editions than any other vehicle in recent memory.

It was a refreshing new model in an era populated with a lot of redundant designs.

Bob Casey, curator of transportation at The Henry Ford museum in Dearborn, Mich., said the PT Cruiser, unlike the minivan, mixed practical function with attitude.

"Every time I see one I smile," he said. "I can well understand why they sold more than 1 million."

Unlike the Thunderbird and Mini, the PT Cruiser also made retro styling affordable to the masses, regardless of income, without trading away utility.

"It was an ideal single car or second family car," said Erich Merkle, an automotive analyst and president of Autoconomy.com. "For Chrysler, it was a gamble that paid off for 5 to 7 years."

Cash cow

It is the most profitable small car in Chrysler history, according to Bryan Nesbitt, who designed the original PT Cruiser for the old Chrysler Corp. Nesbitt is now a top General Motors Co. designer, while his former employer has since been steered by Daimler AG, Cerberus and Fiat S.p.A.

With the end of the PT Cruiser, Chrysler is retooling the Toluca, Mexico, plant to build the Fiat 500 -- a tiny car to be sold in the U.S. market beginning next year.

The PT Cruiser was originally tapped to join the aluminum Prowler roadster to bolster the ailing Plymouth brand. But when Chrysler planners scrapped Plymouth, the PT Cruiser was spared and christened a Chrysler, eventually becoming one of the brand's top-selling models.

Its offbeat style immediately attracted a variety of buyers -- the young, tuners, entrepreneurs and retirees. Many owners quickly fell in love with its functionality and quirky interior. The wagon's rear seats were removable, allowing the tall interior to stow large cargo.

To keep consumers interested, Chrysler added a convertible version, a woody model and a turbo engine. Special editions -- dubbed Flames, Chrome, Couture and Dream Cruiser -- were routinely added.

But over the years it mostly stayed the same and the novelty slowly wore off.

As with many retro-styled cars, an automaker can paint itself into a corner. Where do you go next?

"Chrysler stopped caring about it and the interior suffered from a lack of upgrades," said Joe Kyriakoza, vice president of marketing for Jumpstart Automotive Group.

But in a testament to its lasting appeal, even in recent years, the PT Cruiser was one of the most researched vehicles in Chrysler's lineup on many online shopping sites.

Annual global sales peaked at 192,000 in 2001, and in the absence of a major redesign, demand dropped to just 25,200 last year. In a nod to the original, the last models are referred to by Chrysler simply as PT Cruiser Classics.

"In the end, it was a hard act to follow because it was a fairly unique," said Casey. "They got it right, right out of the box."

Thursday, June 03, 2010

Mercury production to end in Q4

Ford Motor Co. will discontinue its 71-year-old Mercury brand and end vehicle production in the fourth quarter, Mark Fields, Ford's president of the Americas, said today.

Fields also announced plans to expand the Lincoln lineup with seven new or refreshed vehicles in the next four years.

Ford product development chief Derrick Kuzak said a new compact car will be developed for Lincoln. The car will be based on the same platform that the 2011 Ford Focus sits on, but it will be designed and engineered specifically for Lincoln, he said.

The final decision to kill Mercury was made this week and approved by Ford's board today, Fields said.

A total of 1,712 dealerships sell the Mercury brand in the United States, but there are no stand-alone Mercury stores. Among the Mercury stores, 511 also have Ford franchises, 276 are combined with Lincoln franchises, and 925 are dualed with both Ford and Lincoln franchises.

Some of the 276 Lincoln-Mercury dealerships are in markets that cannot support a stand-alone Lincoln store, Fields said. He said Ford Motor will work with those stores, helping them to either get a Ford franchise or consolidate their Lincoln franchise with a Ford store.

“We do foresee in some markets there could be some stand-alone Lincoln dealerships,” Fields said.

More information to come

Mercury dealers will all receive packets tomorrow morning outlining Ford's transition plan for the brand and outlining monetary compensation for their stores based on a formula Ford has developed, Fields said.

Fields said Ford decided to close Mercury during its annual spring business and product review. Ford division's improved market share -- up 2.2 percentage points through April compared with last year -- combined with the fact that most Mercury customers cross-shop the Ford brand, made it sensible to cut Mercury, Fields said.

“And it allows us to put 100 percent of our resources into Ford and Lincoln,” he said.

Dealer Bob Tasca Jr., who heads the Lincoln Mercury brands of the dealer council, calls this an emotional decision because it will affect dealers' lives.

“Some of the dealers have their homes mortgaged to their business,” said Tasca, who has two Ford-Lincoln/Mercury stores, one in Rhode Island and one in Massachusetts. “Some are going to make it, and some won't. But I really expect Ford will be fair.”

Ed Tonkin, chairman of the National Automobile Dealers Association, called it “a sad day.”

“NADA's concern is that Ford treats each of its Mercury dealers fairly and equitably,” he said, “especially the 276 of whom sell Lincoln and Mercury exclusively.

“Ford also needs to move quickly to take into account the millions of dollars that dealers have invested in facilities, equipment, personnel and training. They deserve fair compensation.”

Fields said Ford will offer special incentives to move Mercury vehicles this summer. He said he expects most of the Mercury inventory to be sold off by the end of this year.

There will be no job cuts that result from the demise of Mercury. Ford will redeploy any Mercury personnel to the Lincoln brand.

Besides an expanded lineup, Lincoln also gets an expanded marketing team, Fields said.

Ford declined to reveal how much it will cost the company to discontinue Mercury but said Ford's recent profitability has made it possible to make the move now. Ford reported a second quarter net profit of $2.1 billion.

Good thing in the long run

Peter Gervais, general manager of Gervais Lincoln-Mercury in Lowell, Mass., said in the long run the move “will probably be a good thing.”

"Lincoln has a little more brand status than Mercury," he added. “I think it was overdue and it should have happened beforehand.”

Ed Witt of Witt Lincoln-Mercury in San Diego, Calif., said he was optimistic about the switch.

“We love our Mercury brand. On the other hand, we are excited to take on a brand like Lincoln and making it a luxury brand. They're going to take the Lincoln brand to where it's never been before.”

He said he though Ford's leadership would take care of the Mercury dealers.

“Look at what they've been doing,” he said. “They've done it through leadership and focus and that's what we're going to do with Lincoln. This Mercury question has been around forever, a thorn in my saddle.

“We have definition, we have structure, and we have focus and direction. What else could I want? I think it's a big opportunity.”

Dealers reached by Automotive News said they weren't surprised.

“All I can say is this: I hate it,” said Robert Hammett, general manager of Hammett Motor Co. in Durant, Miss. “But they really don't need to make two of the same vehicles and put two different names on them. Mercury should have been a totally different outfit. Everybody has been expecting it.”

Glenn Mahoney, sales manager at Dana Ford Lincoln Mercury in Staten Island, N.Y., said some customers have been concerned.

“The dealers will still be here to warrant the cars, we're a dual point,” he said. “I think it is going be great, if we actually expand the Lincoln brand. It's kind of an overkill (with Lincoln and Mercury). The product lines are practically on top of each other.

“So, from that standpoint it was an interchangeable part. From being a dual store, it was nice to have both sides for us. It was kind of nice to have that area to move. I think Mercury sales will do pretty well throughout the end of the year.”

Fields also announced plans to expand the Lincoln lineup with seven new or refreshed vehicles in the next four years.

Ford product development chief Derrick Kuzak said a new compact car will be developed for Lincoln. The car will be based on the same platform that the 2011 Ford Focus sits on, but it will be designed and engineered specifically for Lincoln, he said.

The final decision to kill Mercury was made this week and approved by Ford's board today, Fields said.

A total of 1,712 dealerships sell the Mercury brand in the United States, but there are no stand-alone Mercury stores. Among the Mercury stores, 511 also have Ford franchises, 276 are combined with Lincoln franchises, and 925 are dualed with both Ford and Lincoln franchises.

Some of the 276 Lincoln-Mercury dealerships are in markets that cannot support a stand-alone Lincoln store, Fields said. He said Ford Motor will work with those stores, helping them to either get a Ford franchise or consolidate their Lincoln franchise with a Ford store.

“We do foresee in some markets there could be some stand-alone Lincoln dealerships,” Fields said.

More information to come

Mercury dealers will all receive packets tomorrow morning outlining Ford's transition plan for the brand and outlining monetary compensation for their stores based on a formula Ford has developed, Fields said.

Fields said Ford decided to close Mercury during its annual spring business and product review. Ford division's improved market share -- up 2.2 percentage points through April compared with last year -- combined with the fact that most Mercury customers cross-shop the Ford brand, made it sensible to cut Mercury, Fields said.

“And it allows us to put 100 percent of our resources into Ford and Lincoln,” he said.

Dealer Bob Tasca Jr., who heads the Lincoln Mercury brands of the dealer council, calls this an emotional decision because it will affect dealers' lives.

“Some of the dealers have their homes mortgaged to their business,” said Tasca, who has two Ford-Lincoln/Mercury stores, one in Rhode Island and one in Massachusetts. “Some are going to make it, and some won't. But I really expect Ford will be fair.”

Ed Tonkin, chairman of the National Automobile Dealers Association, called it “a sad day.”

“NADA's concern is that Ford treats each of its Mercury dealers fairly and equitably,” he said, “especially the 276 of whom sell Lincoln and Mercury exclusively.

“Ford also needs to move quickly to take into account the millions of dollars that dealers have invested in facilities, equipment, personnel and training. They deserve fair compensation.”

Fields said Ford will offer special incentives to move Mercury vehicles this summer. He said he expects most of the Mercury inventory to be sold off by the end of this year.

There will be no job cuts that result from the demise of Mercury. Ford will redeploy any Mercury personnel to the Lincoln brand.

Besides an expanded lineup, Lincoln also gets an expanded marketing team, Fields said.

Ford declined to reveal how much it will cost the company to discontinue Mercury but said Ford's recent profitability has made it possible to make the move now. Ford reported a second quarter net profit of $2.1 billion.

Good thing in the long run

Peter Gervais, general manager of Gervais Lincoln-Mercury in Lowell, Mass., said in the long run the move “will probably be a good thing.”

"Lincoln has a little more brand status than Mercury," he added. “I think it was overdue and it should have happened beforehand.”

Ed Witt of Witt Lincoln-Mercury in San Diego, Calif., said he was optimistic about the switch.

“We love our Mercury brand. On the other hand, we are excited to take on a brand like Lincoln and making it a luxury brand. They're going to take the Lincoln brand to where it's never been before.”

He said he though Ford's leadership would take care of the Mercury dealers.

“Look at what they've been doing,” he said. “They've done it through leadership and focus and that's what we're going to do with Lincoln. This Mercury question has been around forever, a thorn in my saddle.

“We have definition, we have structure, and we have focus and direction. What else could I want? I think it's a big opportunity.”

Dealers reached by Automotive News said they weren't surprised.

“All I can say is this: I hate it,” said Robert Hammett, general manager of Hammett Motor Co. in Durant, Miss. “But they really don't need to make two of the same vehicles and put two different names on them. Mercury should have been a totally different outfit. Everybody has been expecting it.”

Glenn Mahoney, sales manager at Dana Ford Lincoln Mercury in Staten Island, N.Y., said some customers have been concerned.

“The dealers will still be here to warrant the cars, we're a dual point,” he said. “I think it is going be great, if we actually expand the Lincoln brand. It's kind of an overkill (with Lincoln and Mercury). The product lines are practically on top of each other.

“So, from that standpoint it was an interchangeable part. From being a dual store, it was nice to have both sides for us. It was kind of nice to have that area to move. I think Mercury sales will do pretty well throughout the end of the year.”

Thursday, May 20, 2010

Tesla to make EVs with Toyota, buy NUMMI

Toyota Motor Corp. and Tesla Motors Inc. will become partners to produce electric vehicles at New United Motor Manufacturing Inc. in Fremont, Calif., a plant that Toyota last year ruled too inefficient to keep open.

Tesla will acquire the now-closed NUMMI property and employ 1,000 people building unspecified electric vehicles in a partnership with the world's largest automaker, the companies announced today in Palo Alto, Calif.

Toyota will invest $50 million in the small California-based electric sports maker in exchange for Tesla's common stock when the EV company completes its planned initial public offering.

Speaking at the announcement, Toyota President Akio Toyoda said he admired the entrepreneurial spirit at Tesla and hoped the venture will teach Toyota about quick decision-making and flexibility.

“Decades ago,” Toyoda said, “Toyota was also born as a venture business. By partnering with Tesla, my hope is that all Toyota employees will recall that venture business spirit, and take on the challenges of the future.”

Tesla CEO Elon Musk said his company would spend “a couple of hundred million dollars” preparing NUMMI for the project.

NUMMI, a former joint venture between Toyota and General Motors, closed earlier this year amid a storm of criticism from the plant's UAW work force.

Musk said the negotiations to acquire the closed plant concluded yesterday.

He said that Tesla's next model, a Model S that will debut in 2012, will only account for about 20,000 units a year, but said other models will follow off of the Model S platform.

“We're going to be occupying a little corner,” Musk said.

He said that eventually the project would account for 10,000 jobs, including supplier jobs.

Tesla's Model S is being made possible thanks to a $465 million low-interest loan from the U.S. Department of Energy. Until that product appears, Tesla is marketing a two-seat electric sports car that retails for more than $100,000.

Tesla has said that the Model S will sell for closer to $40,000.

Until now, Toyota has expressed little interest in electric cars. The Japanese automaker has staked considerable research and marketing investment on its popular hybrid-drive vehicles, including the Prius and hybrid Camry

Tesla will acquire the now-closed NUMMI property and employ 1,000 people building unspecified electric vehicles in a partnership with the world's largest automaker, the companies announced today in Palo Alto, Calif.

Toyota will invest $50 million in the small California-based electric sports maker in exchange for Tesla's common stock when the EV company completes its planned initial public offering.

Speaking at the announcement, Toyota President Akio Toyoda said he admired the entrepreneurial spirit at Tesla and hoped the venture will teach Toyota about quick decision-making and flexibility.

“Decades ago,” Toyoda said, “Toyota was also born as a venture business. By partnering with Tesla, my hope is that all Toyota employees will recall that venture business spirit, and take on the challenges of the future.”

Tesla CEO Elon Musk said his company would spend “a couple of hundred million dollars” preparing NUMMI for the project.

NUMMI, a former joint venture between Toyota and General Motors, closed earlier this year amid a storm of criticism from the plant's UAW work force.

Musk said the negotiations to acquire the closed plant concluded yesterday.

He said that Tesla's next model, a Model S that will debut in 2012, will only account for about 20,000 units a year, but said other models will follow off of the Model S platform.

“We're going to be occupying a little corner,” Musk said.

He said that eventually the project would account for 10,000 jobs, including supplier jobs.

Tesla's Model S is being made possible thanks to a $465 million low-interest loan from the U.S. Department of Energy. Until that product appears, Tesla is marketing a two-seat electric sports car that retails for more than $100,000.

Tesla has said that the Model S will sell for closer to $40,000.

Until now, Toyota has expressed little interest in electric cars. The Japanese automaker has staked considerable research and marketing investment on its popular hybrid-drive vehicles, including the Prius and hybrid Camry

Tuesday, May 18, 2010

GM posts $865 million Q1 profit

General Motors Co. posted a first-quarter profit as production snapped back and said it was making progress on a turnaround expected to put it on track toward its first full-year profit since 2004.

Analysts said the results underscored the progress GM made by slashing costs in a bankruptcy funded by the Obama administration and kept open the prospect of the automaker launching an initial public offering as soon as this year.

GM recorded a net profit of $865 million, compared with a loss of $5.98 billion a year before, as it ramped up production by nearly 57 percent from year-earlier levels to meet steadier demand in the United States and a sales boom in China.

"Now that we have achieved profitability, the next step is to achieve sustainable profitability," CFO Chris Liddell told reporters.

Liddell said GM had a "good chance" of making a profit for all of 2010, although gains from ramping up production would fade after the first quarter.

He declined to offer a forecast for the rest of 2010. He also put some conditions on the timing of a possible initial public offering.

GM will make an IPO only “when the markets and the company are ready,” he said. “What's out of our control are the readiness of the markets and the status of the global auto industry.”

In addition, GM Controller Nick Cyprus cautioned that GM must further refine its internal financial controls before company managers have a clear view of financial performance. He expressed optimism that would be accomplished before an IPO.

GM received $50 billion of U.S. government financing for its restructuring in bankruptcy. It has been aiming to launch an IPO that would allow the U.S. government to reduce its stake of nearly 61 percent in the automaker.

“The unfortunate process of bankruptcy is yielding positive results,” Rebecca Lindland, an analyst at IHS Global Insight, said in an interview. “It certainly keeps them on track for an IPO.”

Revenue soars

First-quarter revenue was $31.48 billion, a 40 percent advance from a year earlier, when GM was on the brink of bankruptcy after collapsing U.S. demand sent the industry into a tailspin. The automaker generated $1 billion in free cash flow during the quarter and said it ended the period with $35.7 billion in cash.

GM's first-quarter global sales rose 23 percent to nearly 2 million vehicles, including sales of GM's affiliate brands in China: Wuling and FAW-GM.

GM used bankruptcy to drop brands, cull U.S. dealerships and reduce debt. At the end of the first quarter, GM had debt and preferred stock of just over $20 billion, down from $54 billion a year earlier with government creditors taking the place of bondholders.

"The promise of the bankruptcy was to reduce costs, and it worked. That bodes well for the future," said John Wolkonowicz, an analyst with IHS Global Insight.

GM posted a $4.3 billion loss in 2009, from the time it emerged from bankruptcy in early July until the end of the year. The automaker fell into bankruptcy after losses of about $88 billion from 2005 through the first quarter of 2009.

Analysts have said GM still faces steep challenges in repairing the reputation of its brands led by Chevrolet in its home market. Another area of weakness is Europe, where GM posted a first-quarter loss of $506 million and sales for its Opel and Vauxhall brands were down almost 1 percent.

"They're headed in the right direction, but one quarter is not going to turn the ship around," said Mirko Mikelic, a portfolio manager for Fifth Third Asset Management.

GM's market share was stable at 11 percent of global sales and at about 18 percent of North American sales.

U.S. rivals

IHS Global Insight's Wolkonowicz said the results showed GM was in a stronger position than its smaller rival, Chrysler, while still lagging Ford Motor Co. Ford posted a $2.1 billion first-quarter profit and has forecast that it will be solidly profitable for 2010.

In a step aimed at strengthening its ability to compete with rivals, GM has been looking at options to re-establish a captive auto financing arm, people with knowledge of the plans said last week.

Such a move would mark a nearly complete reversal of the process that started in late 2006 when GM sold off a controlling stake in GMAC to raise cash.

Detroit-based GMAC, now known as Ally Financial, is 56 percent owned by the U.S. Treasury after the government injected $17 billion as part of a restructuring that also saw the finance company become a commercial bank.

Liddell said it was "incredibly important" for GM to have a strong financing partner but said it was "debatable" whether that needed to be a captive finance firm as GMAC once was.

Analysts said the results underscored the progress GM made by slashing costs in a bankruptcy funded by the Obama administration and kept open the prospect of the automaker launching an initial public offering as soon as this year.

GM recorded a net profit of $865 million, compared with a loss of $5.98 billion a year before, as it ramped up production by nearly 57 percent from year-earlier levels to meet steadier demand in the United States and a sales boom in China.

"Now that we have achieved profitability, the next step is to achieve sustainable profitability," CFO Chris Liddell told reporters.

Liddell said GM had a "good chance" of making a profit for all of 2010, although gains from ramping up production would fade after the first quarter.

He declined to offer a forecast for the rest of 2010. He also put some conditions on the timing of a possible initial public offering.

GM will make an IPO only “when the markets and the company are ready,” he said. “What's out of our control are the readiness of the markets and the status of the global auto industry.”

In addition, GM Controller Nick Cyprus cautioned that GM must further refine its internal financial controls before company managers have a clear view of financial performance. He expressed optimism that would be accomplished before an IPO.

GM received $50 billion of U.S. government financing for its restructuring in bankruptcy. It has been aiming to launch an IPO that would allow the U.S. government to reduce its stake of nearly 61 percent in the automaker.

“The unfortunate process of bankruptcy is yielding positive results,” Rebecca Lindland, an analyst at IHS Global Insight, said in an interview. “It certainly keeps them on track for an IPO.”

Revenue soars

First-quarter revenue was $31.48 billion, a 40 percent advance from a year earlier, when GM was on the brink of bankruptcy after collapsing U.S. demand sent the industry into a tailspin. The automaker generated $1 billion in free cash flow during the quarter and said it ended the period with $35.7 billion in cash.

GM's first-quarter global sales rose 23 percent to nearly 2 million vehicles, including sales of GM's affiliate brands in China: Wuling and FAW-GM.

GM used bankruptcy to drop brands, cull U.S. dealerships and reduce debt. At the end of the first quarter, GM had debt and preferred stock of just over $20 billion, down from $54 billion a year earlier with government creditors taking the place of bondholders.

"The promise of the bankruptcy was to reduce costs, and it worked. That bodes well for the future," said John Wolkonowicz, an analyst with IHS Global Insight.

GM posted a $4.3 billion loss in 2009, from the time it emerged from bankruptcy in early July until the end of the year. The automaker fell into bankruptcy after losses of about $88 billion from 2005 through the first quarter of 2009.

Analysts have said GM still faces steep challenges in repairing the reputation of its brands led by Chevrolet in its home market. Another area of weakness is Europe, where GM posted a first-quarter loss of $506 million and sales for its Opel and Vauxhall brands were down almost 1 percent.

"They're headed in the right direction, but one quarter is not going to turn the ship around," said Mirko Mikelic, a portfolio manager for Fifth Third Asset Management.

GM's market share was stable at 11 percent of global sales and at about 18 percent of North American sales.

U.S. rivals

IHS Global Insight's Wolkonowicz said the results showed GM was in a stronger position than its smaller rival, Chrysler, while still lagging Ford Motor Co. Ford posted a $2.1 billion first-quarter profit and has forecast that it will be solidly profitable for 2010.

In a step aimed at strengthening its ability to compete with rivals, GM has been looking at options to re-establish a captive auto financing arm, people with knowledge of the plans said last week.

Such a move would mark a nearly complete reversal of the process that started in late 2006 when GM sold off a controlling stake in GMAC to raise cash.

Detroit-based GMAC, now known as Ally Financial, is 56 percent owned by the U.S. Treasury after the government injected $17 billion as part of a restructuring that also saw the finance company become a commercial bank.

Liddell said it was "incredibly important" for GM to have a strong financing partner but said it was "debatable" whether that needed to be a captive finance firm as GMAC once was.